38 what is the coupon rate of a bond

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Bond Prices, Rates, and Yields - Fidelity Remember that a fixed-rate bond’s coupon rate is generally unchanged for the life of the bond. The longer a bond's maturity, the more chance there is that inflation will rise rapidly at some point and lower the bond's price. That's one reason bonds with a long maturity offer somewhat higher interest rates: They need to do so to attract buyers ...

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures.; Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

What is the coupon rate of a bond

Opening of new floating-rate bond for the funding of FlexKort® Telephone +45 7012 5300. 24 November 2022. Company Announcement number 104/2022. Opening of new floating-rate bond for the funding of FlexKort®. Realkredit Danmark will open a new mortgage ... WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ... Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or ...

What is the coupon rate of a bond. What Is a Bond Coupon, and How Is It Calculated? A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to... What Is the Coupon Rate of a Bond? | SoFi A coupon rate is the nominal interest rate or yield associated with a fixed-income security. A bond coupon rate represents the annual interest rate paid on a bond by the issuer, as determined by the bond's face value. Issuers typically pay bond coupon rates on a semiannual basis. The coupon rate of a bond can tell an investor how much ... What is coupon on bonds? - moneycontrol.com Nov 24, 12:11. Coupon rate on the bonds is nothing but the rate of interest paid by the issuers to the investors on the bond's face value. The coupon rate is the annualised interest amount. Coupon ... Coupon Rate: Formula and Bond Calculation The coupon rate, or nominal yield, is the rate of interest paid to a bondholder by the issuer. The pricing of the coupon on a bond issuance is used to calculate ...

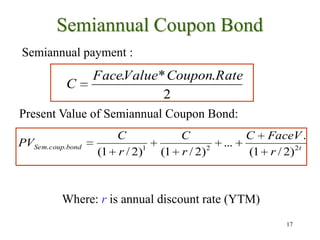

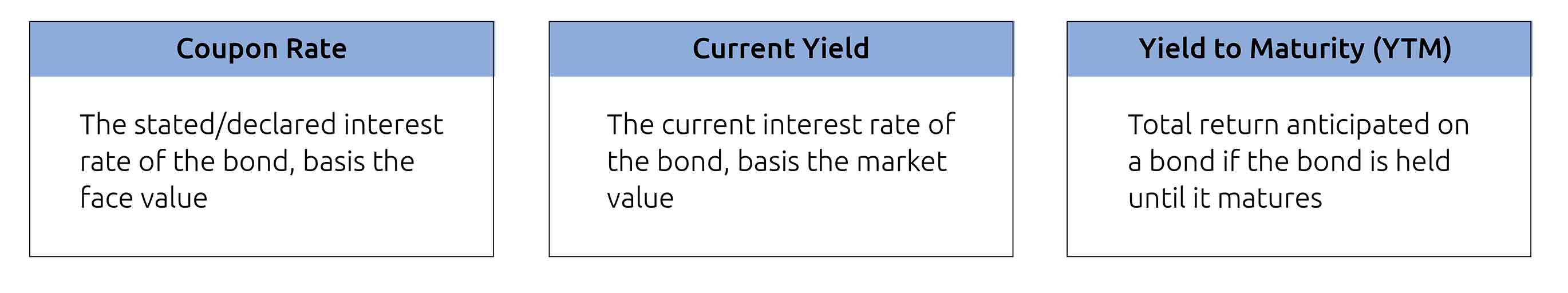

Goi Loan - Bond Price, Yield Percentage, Coupon Rate | IndiaBonds Coupon Rate = Annual Interest Payment / Bond Market Price. What is Yield to Maturity (YTM)? Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it is the discount rate at which the sum of all future cash flows (from coupons and principal ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Answered: What is the coupon rate for a bond with… | bartleby The bonds have a face value of 1,000 and an 8% coupon rate, paid semiannually. The price of the bonds is 1,100. The bonds are callable in 5 years at a call price of 1,050. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Coupon Bond: Definition, How They Work, Example, and Use Today The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

How the Coupon Interest Rate of a Bond Affects Its Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage...

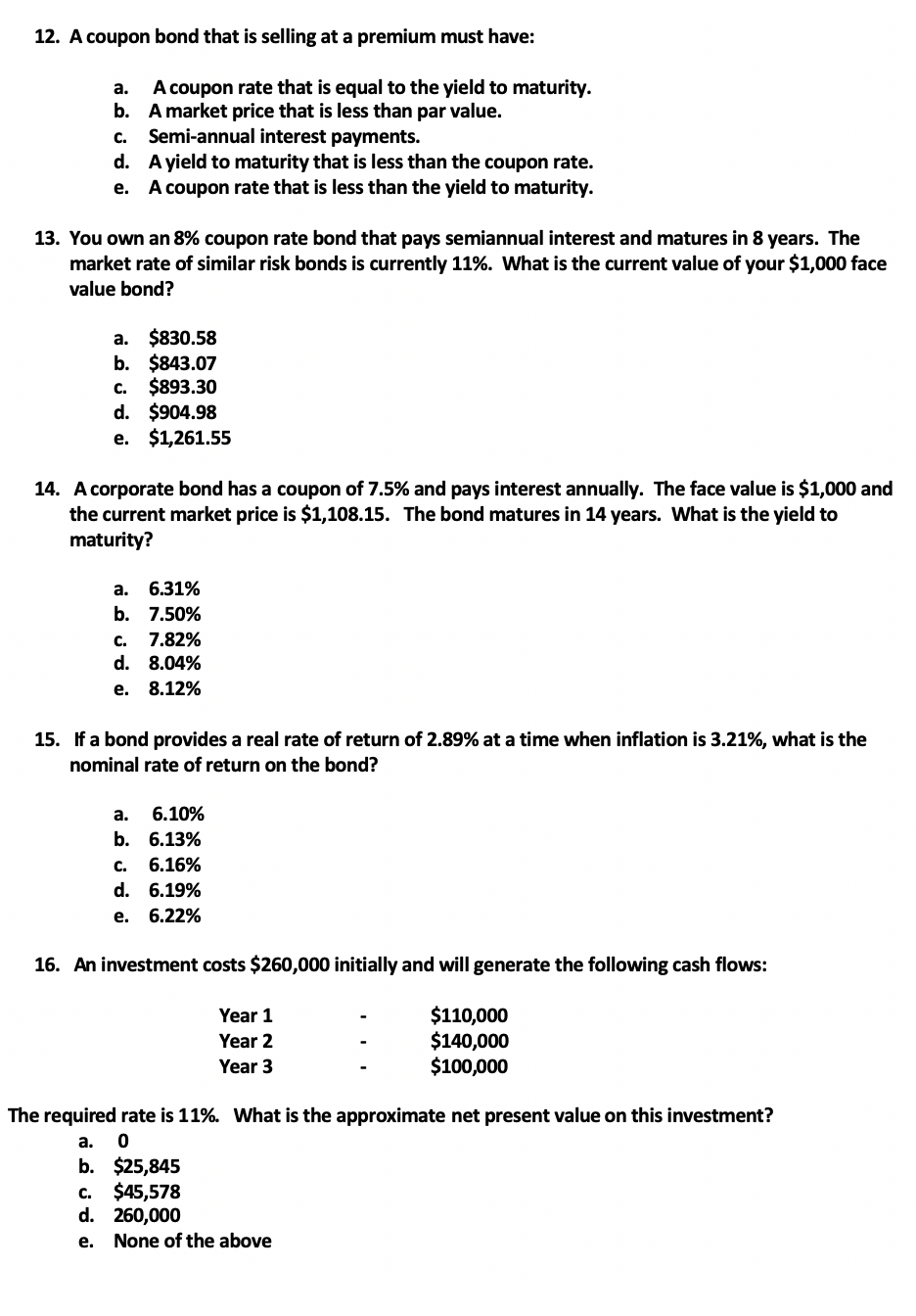

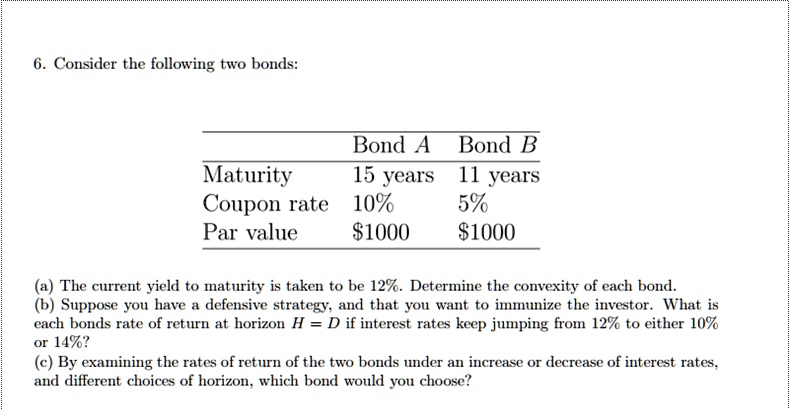

a) What is the 1-year spot rate? b) What is the | Chegg.com All sub-questions a) - I) relate to the following information: You observe the trading price of the following annual zero-coupon and coupon paying Government (risk-free) bonds: You use these bond prices to derive the pure yield curve. Importantly, you have been told that the pure yield curve is flat into perpetuity from year 4 onwards.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a ...

Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What does it mean if a bond has a zero coupon rate? - Investopedia The par value of a bond is the stated value at issuance, usually $100 or $1,000. The coupon rate is largely dependent on federal interest rates. This means that, as interest rates go up...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note

Treasury Coupon Issues | U.S. Department of the Treasury "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value...

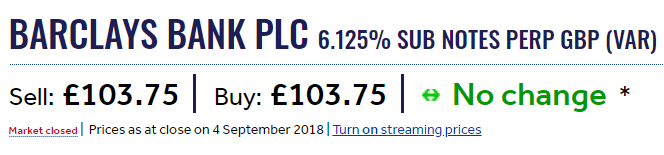

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium.

Interest rate - Wikipedia A discount rate is applied to calculate present value. For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or ...

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

Opening of new floating-rate bond for the funding of FlexKort® Telephone +45 7012 5300. 24 November 2022. Company Announcement number 104/2022. Opening of new floating-rate bond for the funding of FlexKort®. Realkredit Danmark will open a new mortgage ...

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "38 what is the coupon rate of a bond"