40 difference between coupon rate and market rate

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%.... Finance exam 2 Flashcards | Quizlet It is also the expected return for an investor who buys the bond and holds it to maturity. The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) - EDUCBA 3. Interest rates influence the coupon rates. The current yield compares the coupon rate to the market price of the bond. 4. The coupon amount remains the same until maturity. Market price keeps on fluctuating, better to buy a bond at a discount which represents a larger share of the purchase price. 5.

Difference between coupon rate and market rate

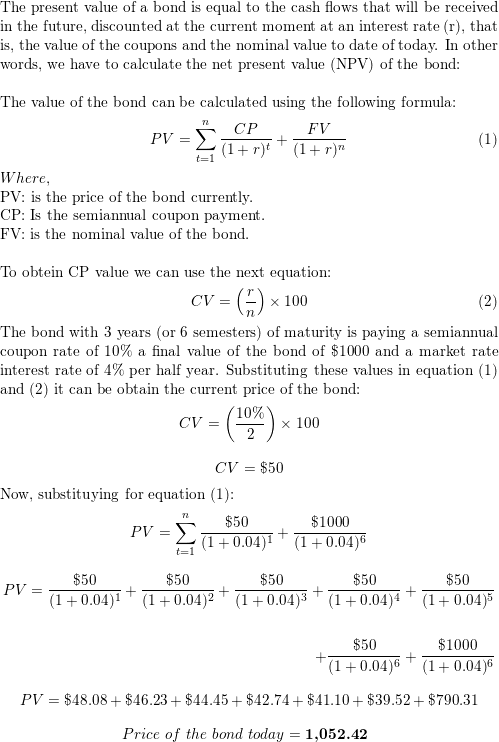

Coupon Rate vs Interest Rate | Top 8 Best Differences (with ... Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ... Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Business Finance - Interest Rates and Bond Valuation A. Coupon Interest Rate Fluctuations B. Mergers C. Market Interest Rate Fluctuations D. Loss of a Bond Certificate, What is a corporate bond's yield to maturity (YTM)? A. YTM is another term for the bond's coupon rate. B. YTM is the yield that will be earned if the bond is sold immediately in the market. C.

Difference between coupon rate and market rate. Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender. What is the difference between a zero-coupon bond and a ... Aug 31, 2020 · The difference between a regular bond and a zero-coupon bond is the payment of interest, otherwise known as coupons.A regular bond pays interest to bondholders, while a zero-coupon bond does not ... Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · The spot interest rate is the rate of return earned when the investor buys and sells the bond without collecting coupon payments. This is extremely common for short-term traders and market makers . Coupon Rate Calculator | Bond Coupon Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate ...

Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author. Difference between YTM and Coupon Rates where "Coupon Payment" is the periodic interest payment made by the issuer, "Par Value" is the face value of the bond that's paid at maturity, "Market Price" is the current price of the bond, and "n" is the number of years until maturity. What is the Coupon Rate? Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. What's the difference between the cost of debt and a coupon rate? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 basis points or 0.5%. That would push up all interest rates.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference. The Difference between a Coupon and Market Rate - BrainMass Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Difference between Yield Coupon Rate - Difference Betweenz The yield rate is the annual percentage of return on investment, while the coupon rate is simply the periodic interest payments (coupons) made on a bond or note. When you are looking at investments, it's important to know which one offers you a higher return. However, it's also important to consider other factors such as risk and liquidity.

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements.

What's the Difference Between Premium Bonds and Discount Bonds? A premium bond has a coupon rate higher than the prevailing interest rate for that bond maturity and credit quality. A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let's say you own an older bond—one that was ...

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

Publication 550 (2021), Investment Income and Expenses ... Market discount. Market discount on a tax-exempt bond is not tax exempt. If you bought the bond after April 30, 1993, you can choose to accrue the market discount over the period you own the bond and include it in your income currently as taxable interest. See Market Discount Bonds, later. If you do not make that choice, or if you bought the ...

Difference Between Coupon Rate and Required Return The coupon rate does is independent of the market value. The required return is dependent on the dividend value. The coupon rate is directly dependent on the bond price, whereas the required return is directly dependent on the risk involved. Coupon Rate has a risk on investment due to the fluctuations of the coupon rate.

What is difference between coupon rate and interest rate? Answer (1 of 10): The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. And then Fed raises its funds rate, 50 bas...

Difference Between Coupon Rate and Interest Rate - diffzy.com The critical difference between coupon rate and interest rate is that interest rate is a fixed rate throughout the life of the investment, while the coupon rate changes from time to time, depending upon market conditions. The coupon rate is always estimated on the par value/ face value of the investment.

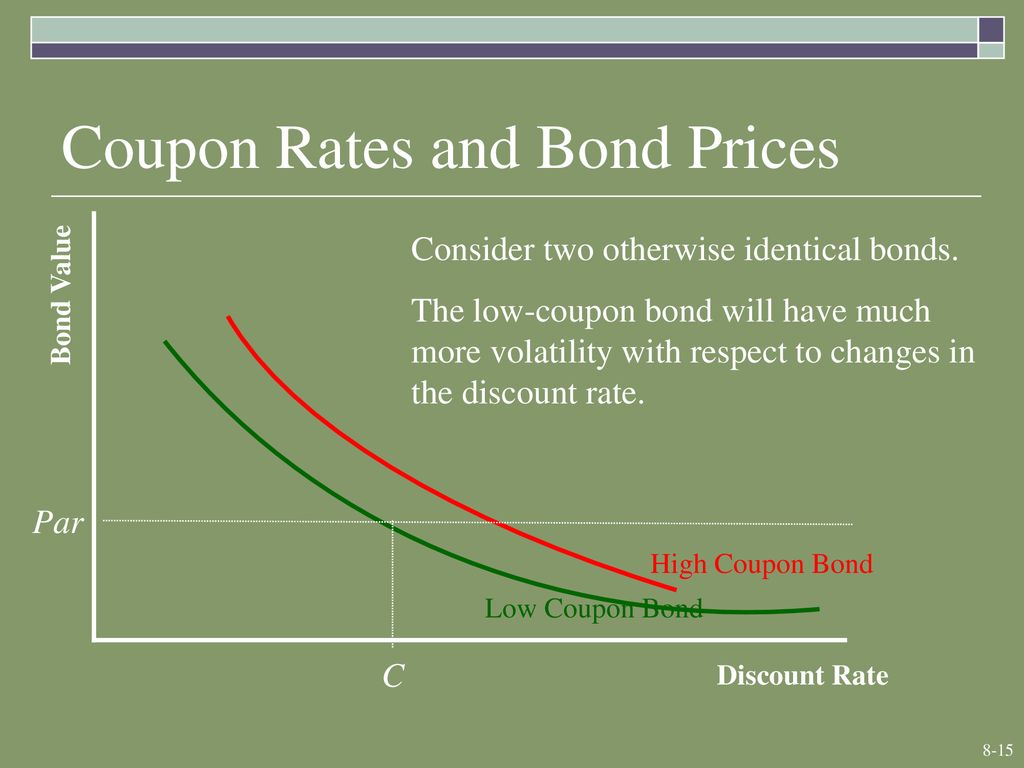

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on the open ...

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · When a bond's yield differs from the coupon rate, this means the bond is either trading at a premium or a discount to incorporate changes in market condition since the issuance of the bond.

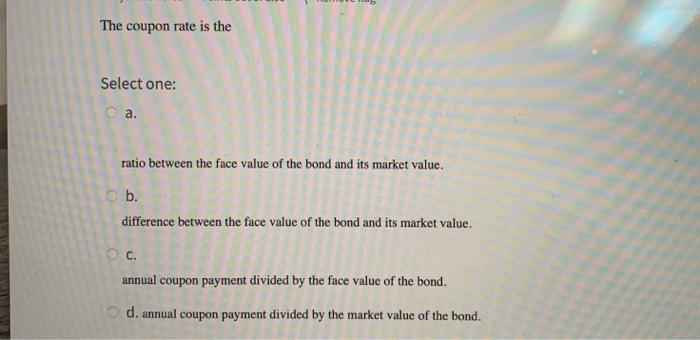

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo Key Differences For the calculation of the coupon rate, the denominator is the face value of the bond, and for the calculation of the yield of a bond, the denominator is the market price of the bond.

Difference Between Coupon Rate and Discount Rate Also referred to as the nominal yield, the Coupon rate on a particular bond is defined as the rate of interest applied on a particular bond whereas coupons are defined as the periodic payments of interest paid to the bondholder by the bond issuer. These payments must continue until the agreed date of maturity as stated by the bond agreement.

What Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

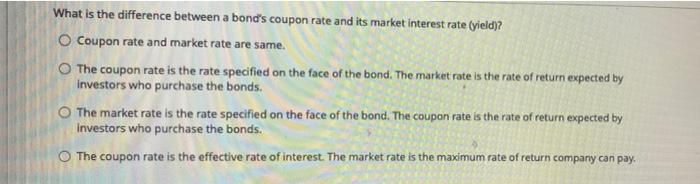

Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ...

What is the difference between coupon rate and market - Course Hero The market can also give a premium rate that is greater, than a discount rate. The reason its called a coupon rate is that before electronic investing each bond that was issued is made of paper called coupons. These were issued to redeem for money.

Business Finance - Interest Rates and Bond Valuation A. Coupon Interest Rate Fluctuations B. Mergers C. Market Interest Rate Fluctuations D. Loss of a Bond Certificate, What is a corporate bond's yield to maturity (YTM)? A. YTM is another term for the bond's coupon rate. B. YTM is the yield that will be earned if the bond is sold immediately in the market. C.

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with ... Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Post a Comment for "40 difference between coupon rate and market rate"