45 t bill coupon rate

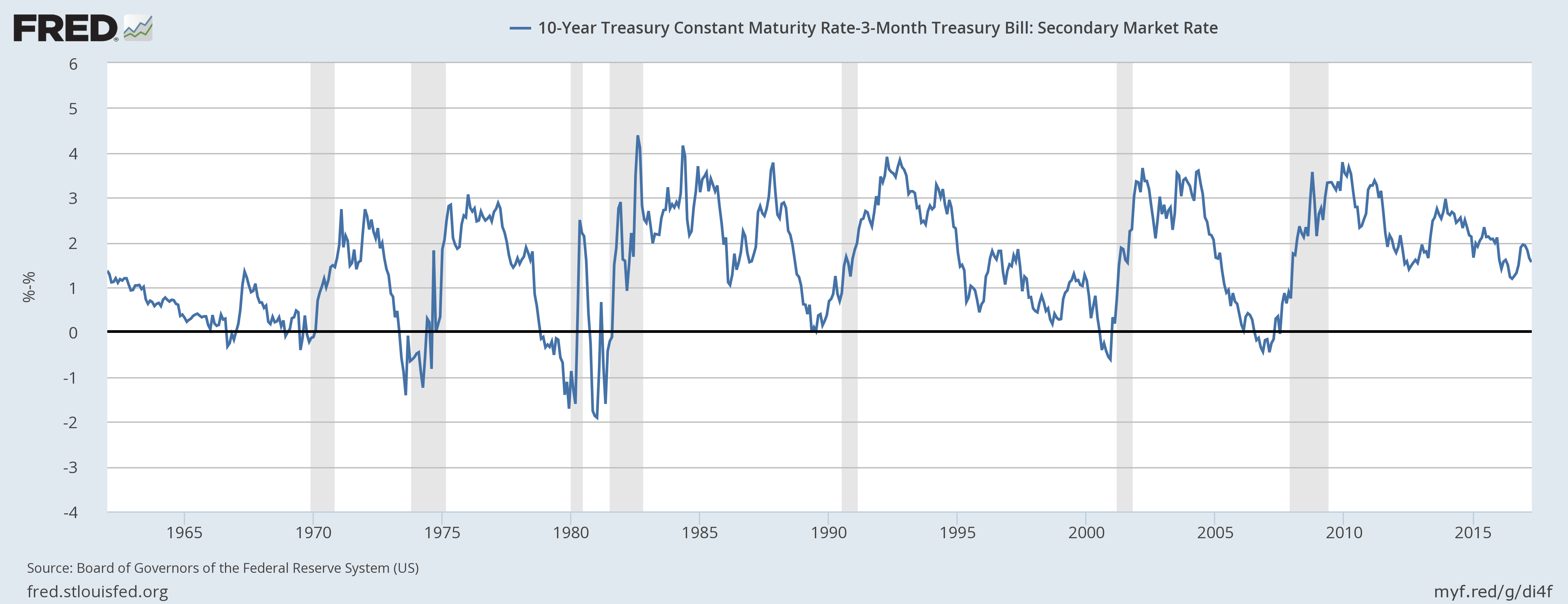

Interest Rates: T-bill - 3 months - economy.com Interest Rates: T-bill - 3 months - Secondary market; discount basis for United States from U.S. Board of Governors of the Federal Reserve System (FRB) for the H.15 Selected Interest Rates [D, W, M] release. This page provides forecast and historical data, charts, statistics, news and updates for United States Interest Rates: T-bill - 3 months - Secondary market; discount basis. Treasury Bills (T-Bills) - Meaning, Examples, Calculations Treasury bills are a type of zero-coupon security where the central government borrows funds from the individual for a period of 364 days or less. In return, the investors receive interest. ... For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases ...

Individual - Treasury Bills: Rates & Terms Treasury Bills: Rates & Terms. Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest. Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 ...

T bill coupon rate

Treasury Bills (T-Bills) Definition - Investopedia Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ... Treasury Bills - Guide to Understanding How T-Bills Work For example, a $1,000 T-bill may be sold for $970 for a three-month T-bill, $950 for a six-month T-bill, and $900 for a twelve-month T-bill. Investors demand a higher rate of return to compensate them for tying up their money for a longer period of time. Risk Tolerance. An investor's risk tolerance levels also affect the price of a T-bill. Individual - Treasury Bills In Depth Treasury Bills In Depth. Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).*. When the bill matures, you would be paid its face value, $1,000.

T bill coupon rate. TMUBMUSD01M | U.S. 1 Month Treasury Bill Overview | MarketWatch December T-bill yields spike as debt ceiling extension kicks can down the road Prices for 3-month Treasury bills fall even as 1-month Treasury bills recover Sep. 6, 2017 at 3:28 p.m. ET by Sunny Oh 20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.59%, compared to 3.64% the previous market day and 2.13% last year. This is lower than the long term average of 4.37%. US Treasury Bill Calculator [ T-Bill Calculator ] The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button. What Are Treasury Bills (T-Bills), and Should You Invest? - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes.

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 98.55: 0 ... Should You Buy Treasuries? For example, assume you buy a one-year T-bill with a $1 million par value and a 2% yield to maturity. When the bill matures, your total dollar return is roughly $20,000. Selected Treasury Bill Yields - Bank of Canada Treasury bills. Treasury bill yields presented are an average of sample secondary market yields taken throughout the business day. Data available as: CSV, JSON and XML. Series. 2022‑06‑15. 2022‑06‑22. 2022‑06‑29. 2022‑07‑06. 2022‑07‑13. United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular weekly T-bills are commonly issued with maturity dates of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data 91 Day T Bill Treasury Rate - Bankrate Treasury securities Updated: 07/05/2022. This week. Month ago. Year ago. 91-day T-bill auction avg disc rate. 1.75. 1.64. 0.05. What it means: The U.S. government issues short-term debt at a ... United States - Treasury Bills: 26-week - High rate Treasury Bills: 26-week - High rate for United States from U.S. Bureau of Public Debt for the Treasury auctions - 13- and 26-week (91- and 182-day) T-Bills release. ... but the coupon payments and underlying principal are adjusted to compensate for inflation as measured by the CPI. Therefore, the real rate of return is guaranteed, but the cost ... Your Money: How rate of return on T-Bills is calculated The discount is (100 x 0.06 x 108 ÷ 360) = 1.80. Thus, the price will be quoted as Rs 100 - Rs 1.80 = Rs 98.20. The quoted rate is called the discount rate. In the case of other securities, the ...

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

13 Week Treasury Bill (^IRX) Historical Data - Yahoo Finance Get historical data for the 13 Week Treasury Bill (^IRX) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions.

1 Year Treasury Bill Rate - YCharts In depth view into 1 Year Treasury Bill Rate including historical data from 1959, charts and stats. 1 Year Treasury Bill Rate 2.55% for Jun 2022 Overview; Interactive Chart; Level Chart. Basic Info. 1 Year Treasury Bill Rate is at 2.55%, compared to 1.97% last month and 0.07% last year. ...

Treasury Bill Rates - Bank of Ghana Treasury Bill Rates. Treasury rates. Home / Treasury and the Markets / Treasury Bill Rates. Treasury Bill Rates. Issue Date Tender Security Type Discount Rate Interest Rate ; Issue Date Tender Security Type Discount Rate Interest Rate; 18 Jul 2022: 1807: 182 DAY BILL: 24.1461: 27.4615: 18 Jul 2022: 1807: 91 DAY BILL: 24.3735: 25.9550 ...

How Are Treasury Bill Interest Rates Determined? - Investopedia The discount spread is $25. After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not ...

What Are the Rates on Treasury Bills in 2020? - TheStreet The low risk comes with the benefit of paying a fixed rate of interest, but the interest rates are generally low. The rates currently range from 0.09% to 0.17% for T-bills that mature from four ...

Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

Reserve Bank of India - Frequently Asked Questions The variable coupon rate for payment of interest on this FRB 2024 was decided to be the average rate rounded off up to two decimal places, of the implicit yields at the cut-off prices of the last three auctions of 182 day T- Bills, held before the date of notification. ... (WAY) of last 3 auctions (from the rate fixing day) of 182 Day T-Bills ...

US Treasury Bonds - Fidelity US Treasury floating rate notes (FRNs) $1,000: Coupon: 2 years: Interest paid quarterly based on discount rates for 13-week treasury bills, principal at maturity: Treasury STRIPS: $1,000: Discount: 6 months to 30 years: Interest and principal paid at maturity * As of June 27, 2022.

Treasuries - WSJ Treasury Notes & Bonds. Treasury Bills. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields ...

Individual - Treasury Bills In Depth Treasury Bills In Depth. Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).*. When the bill matures, you would be paid its face value, $1,000.

Treasury Bills - Guide to Understanding How T-Bills Work For example, a $1,000 T-bill may be sold for $970 for a three-month T-bill, $950 for a six-month T-bill, and $900 for a twelve-month T-bill. Investors demand a higher rate of return to compensate them for tying up their money for a longer period of time. Risk Tolerance. An investor's risk tolerance levels also affect the price of a T-bill.

Treasury Bills (T-Bills) Definition - Investopedia Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

:max_bytes(150000):strip_icc()/bonds-lrg-4-5bfc2b234cedfd0026c104ea.jpg)

Post a Comment for "45 t bill coupon rate"