43 define zero coupon bond

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs...

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

Define zero coupon bond

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... money.usnews.com › the-ultimate-guide-to-bondsThe Ultimate Guide to Bonds | Bonds | US News May 07, 2020 · Instead, investors buy zero-coupon bonds at a discount to par and then receive the full face value when the bond matures. You might pay $10,000 for a bond that will return $20,000 in 20 years.

Define zero coupon bond. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. If Price > 100 "Premium" (Trading Above Par) If Price = 100 "Par" (Trading at Par Value) If Price < 100 "Discount" (Trading Below Par) Zero Coupon Bonds financial definition of Zero Coupon Bonds Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. Zero-coupon bond - definition of zero-coupon bond by The Free Dictionary zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bond

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money. It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond. What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that provides profit for the investor when it reaches maturity. Unlike traditional bonds, zero-coupon securities don't provide interest payments during the life of the bond. Instead, investors make money on these bonds when they buy them at a deep discount. Zero-Coupon Bonds - Accounting Hub Definition. A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. › marketintelligence › enHigh Yield Bond Primer | S&P Global Market Intelligence Zeros were popular with Internet start-ups and wireless build-out projects in the late 1990s. In 1998 for example, zero-coupon issuance was $16 billion, or roughly 12% of total supply. in 2011, in contrast, there were just three such deals in market, raising $1 billion, or just 0.4% of total supply, and none since, according to LCD.

ZERO COUPON BOND | meaning in the Cambridge English Dictionary zero coupon bond definition: a type of bond that does not pay interest, but that you buy for less than its face value , so that…. Learn more. Zero-coupon bond financial definition of Zero-coupon bond Zero-Coupon Bond A bond that pays no interest. It is sold at a discount from par and matures at par. These are fairly illiquid investments because they do not benefit from changes in interest rates. However, they tend to be low- risk. Zero-coupon bonds fluctuate in price, sometimes dramatically, with changes in interest rates. What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself. Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

Zero Coupon Bonds - UWorld Roger CPA Review Zero coupon bonds increase in value every month, but pay no regular interest payments. If you buy a series EE government savings bond, the government will not pay you regular monthly payments, but when you cash it in you will get more than you originally paid for the bond. The interest has been accruing on this bond and you will get both the ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

› specializations › investmentInvestment and Portfolio Management | Coursera Topics covered include: • Explain the roles of financial markets • Distinguish between real and financial assets • Define and explain money market instruments, zero-coupon and coupon- bonds and features • Identify the cash flows associated with fixed-income securities • Define and explain bond market features • List the different ...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Learn About Zero Coupon Bond | Chegg.com Zero Coupon Bond Definition. Zero-coupon bonds are long-term investment bonds that offer no periodic interest payments and are sold at a substantial discount compared to the par value. They are also called deep discount bonds or pure discount bonds. The bondholder receives returns in the form of an increase in the value of the investment ...

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the bond's maturity date. The less you pay for a zero coupon bond, the higher the yield. A bond with a ...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

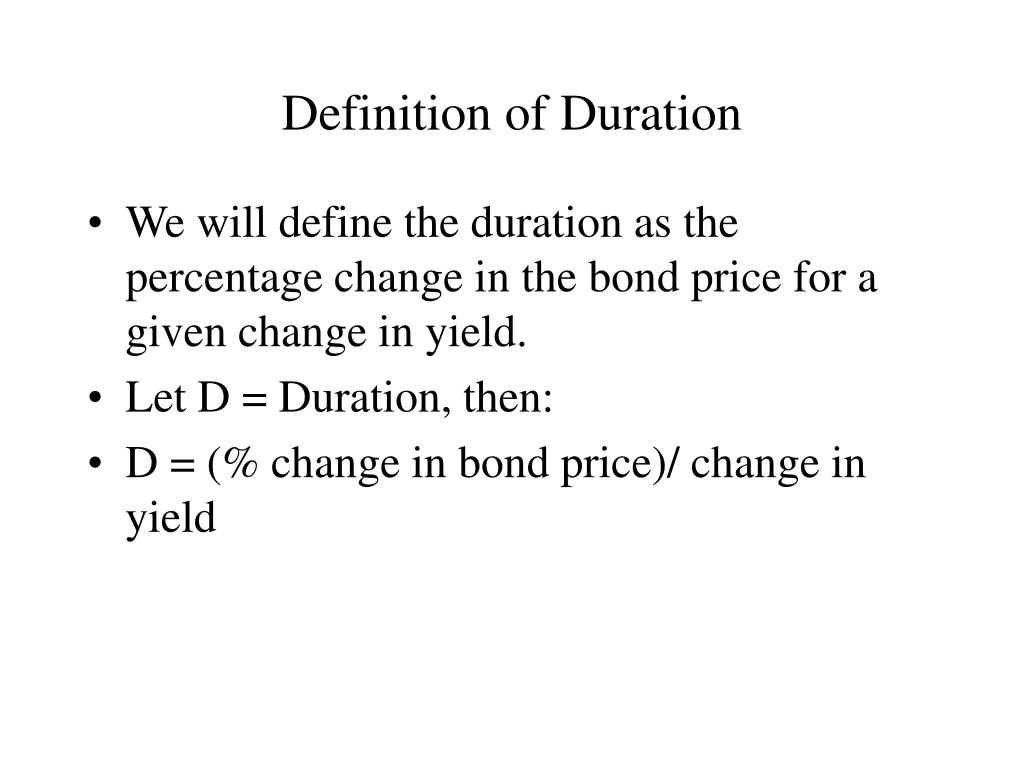

› convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The number of coupon flows (cash flows) change the duration and hence the convexity of the bond. The duration of a zero bond is equal to its time to maturity, but as there still exists a convex relationship between its price and yield, zero-coupon bonds have the highest convexity and its prices most sensitive to changes in yield.

What is the difference between a zero-coupon bond and a regular bond? A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon bonds, so...

› bonds-or-fixed-income-productsCorporate Bonds | Investor.gov Floating rates are based on a bond index or other benchmark. For example, the floating rate may equal the interest rate on a certain type of Treasury bond plus 1%. One type of bond makes no interest payments until the bond matures. These are called zero-coupon bonds, because they make no coupon payments. Instead, the bond makes a single payment ...

Zero coupon bond - definition of zero coupon bond by The Free Dictionary zero coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero-coupon bond

What does zero coupon bond mean? - definitions Definition of zero coupon bond in the Definitions.net dictionary. Meaning of zero coupon bond. Information and translations of zero coupon bond in the most comprehensive dictionary definitions resource on the web.

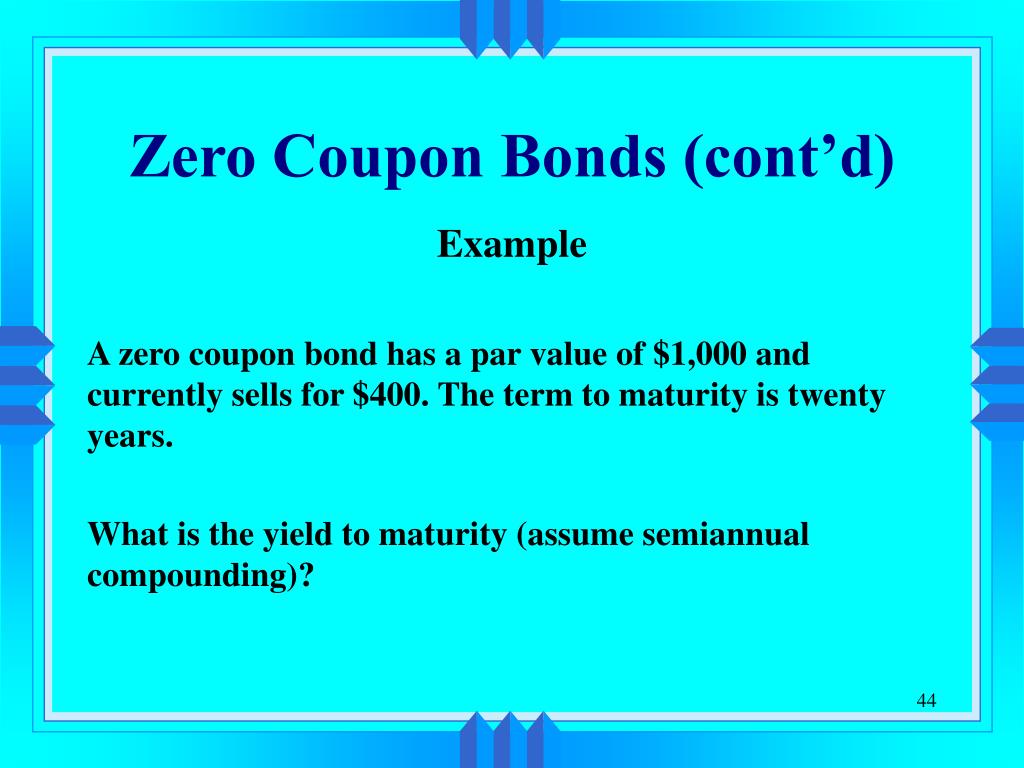

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

What Is a Zero-Coupon Bond? | The Motley Fool So while a traditional bond with a $10,000 face value might sell for $10,000, a zero-coupon bond with a $10,000 face value might sell for $5,000 initially. When to consider zero-coupon bonds

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

byjus.com › govt-exams › types-of-bondsTypes of Bonds - Basics of Bond, General Features and ... Zero-Coupon Bond: When the coupon rate is zero and the issuer is only applicable to repay the principal amount to the investor, such type of bonds are called zero-coupon bonds. Serial Bond: When the issuer continues to pay back the loan amount to the investor every year in small instalments to reduce the final debt, such type of bond is called ...

money.usnews.com › the-ultimate-guide-to-bondsThe Ultimate Guide to Bonds | Bonds | US News May 07, 2020 · Instead, investors buy zero-coupon bonds at a discount to par and then receive the full face value when the bond matures. You might pay $10,000 for a bond that will return $20,000 in 20 years.

Post a Comment for "43 define zero coupon bond"