41 the coupon rate of a bond is equal to

Bond Basics: Issue Size and Date, Maturity Value, Coupon 28.05.2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would ... If the coupon rate of a bond is equal to its required 31) Hewitt Packing Company has an issue of $1,000 par value bonds with a 14 percent annual coupon interest rate. The issue has ten years remaining to the maturity date. Bonds of similar risk are currently selling to yield a 12 percent rate of return.

Solved If the coupon rate of a bond is equal to its required - Chegg This problem has been solved! See the answer If the coupon rate of a bond is equal to its required rate of return, then ________. Select one: a. the current value is not equal to par value b. the current value is equal to par value c. the maturity value is equal to par value d. the current value is equal to maturity value Expert Answer

The coupon rate of a bond is equal to

Zero-Coupon Bond - Definition, How It Works, Formula 28.01.2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than $100 in one year. Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the par (face) value of the bond. Step #2: Enter the bond's coupon rate percentage. Step #3: Select the coupon rate compounding interval. Step #4: Enter the current market rate that a similar bond is selling for. Step #5: Enter the number of years until the bond reaches maturity. Step #6: Click the "Calculate Bond Price" button. Solved a discounts bonds coupon rate is equal to the annual | Chegg.com a discounts bonds coupon rate is equal to the annual interest divided by the Show transcribed image text Expert Answer 100% (6 ratings) Coupon rate = Annual i … View the full answer Transcribed image text: o o o clean price o Current price o < Prev 24 of 36 Next > Previous question Next question

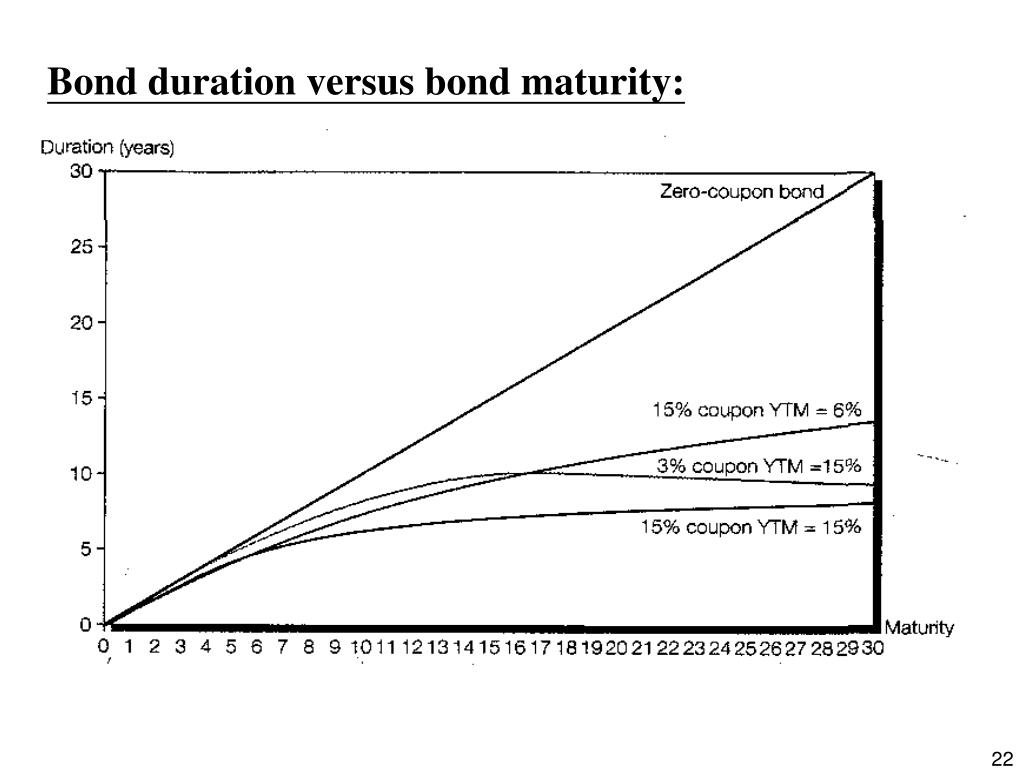

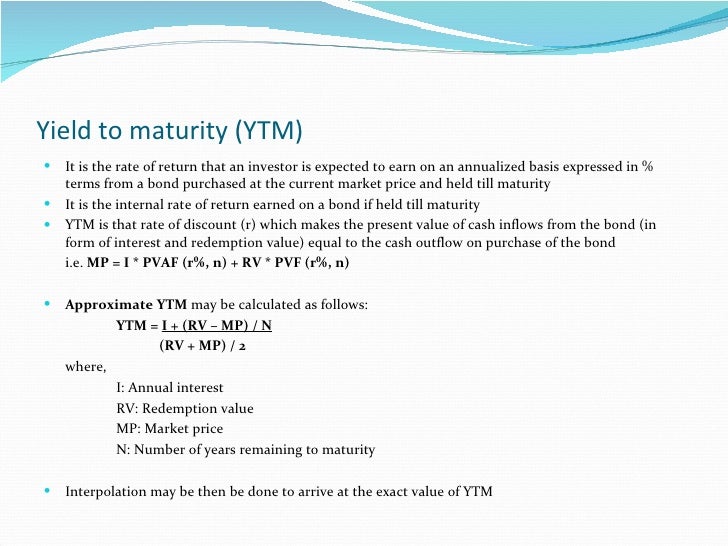

The coupon rate of a bond is equal to. Difference Between Coupon Rate and Yield of Maturity The rate of interest is paid annually at a coupon rate. The current Yield defines the rate of return it generates annually. 3; Interest rate fluctuates in the coupon rate. The current yield compares the coupon rate to the market price of the bond. 4; The coupon amount remains the same till its maturity. Finance Ch 6 Flashcards & Practice Test - Quizlet What condition must exist if a bond's coupon rate is to equal both the bond's current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. A. The clean price of the bond must equal the bond's dirty price. B. The bond must be a zero coupon bond and mature in exactly one year. C. If the coupon rate of a bond is equal to its required - Course Hero bond E will have a greater change in price 31) Hewitt Packing Company has an issue of $1,000 par value bonds with a 14 percent annual coupon interest rate. The issue has ten years remaining to the maturity date. Bonds of similar risk are currently selling to yield a12 percent rate of return. The current value of each Hewitt bond is ________. Par Bond - Overview, Bond Pricing Formula, Example 24.07.2019 · Understanding a Par Bond. A bond’s coupon rate is the rate of interest paid by the bond issuers on the bond’s face value. To understand why a bond with a coupon rate equal to the market interest rate is priced at par, consider the following examples: Example 1: Discount Bond. Consider a bond with a 5-year maturity and a coupon rate of 5% ...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Zero-Coupon Bond Definition - Investopedia 11.11.2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is … If coupon rate is equal to going rate of interest then - Examveda Solution (By Examveda Team) If coupon rate is equal to going rate of interest then bond will be sold at par value. A coupon payment on a bond is the annual interest payment that the bondholder receives from the bond's issue date until it matures. Coupons are normally described in terms of the coupon rate, which is calculated by adding the sum ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). Difference Between Coupon Rate and Discount Rate Securities with low coupon rates will have higher Discount rate hazards than securities that have higher coupon rates. If the financial backer buys an obligation of 10 years, of the assumed worth of $1,000, and a coupon pace of 10%, then, at that point, the bond buyer gets $100 consistently as coupon installments on the bond. All else constant, a bond will sell at _____ when the coupon rate is ... All else constant, a bond will sell at _____ when the coupon rate is _____ the yield to maturity. 1.A premium; equal to, 2.Par; less than, 3.A discount; less than, 4.A discount; higher than, 5.A premium; less than

Finance Chapter 5 Flashcards | Quizlet Finance Chapter 5. All else constant, a bond will sell at ________ when the yield to maturity is ________ the coupon rate. A) a yield to maturity that is less than the coupon rate. B) a coupon rate that is equal to the yield to maturity. C) a market price that is less than par value. D) semiannual interest payments.

If the coupon rate of a bond is equal to its required rate of return ... When the coupon rate of a bond equal to its required rate of return, then it is purchased at par since the initial investment is totally offset by repayment of the bond at maturity, leaving only the fixed coupon payments as profit. The correct answer is - is equal to par value. Advertisement

Coupon Rate Definition - Investopedia 05.09.2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by …

Important Differences Between Coupon and Yield to Maturity The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula. Here we learn how to calculate the Coupon Rate of the Bond using practical examples and a downloadable excel template. You can learn more about Accounting from the following articles –

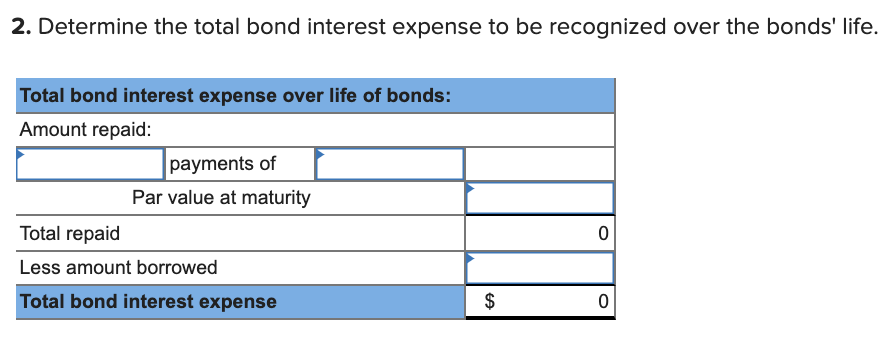

14.3 Accounting for Zero-Coupon Bonds – Financial Accounting Total interest reported for this zero-coupon bond is equal to the difference between the amount received by the debtor and the face value repaid. Both of the accounting problems have been resolved through use of the effective rate method. The $17,800 price of the bond was computed mathematically based on. the cash payment ($20,000), the time periods (two), the effective rate of interest (the 6 ...

Post a Comment for "41 the coupon rate of a bond is equal to"