43 coupon rate and ytm

Understanding the Yield to Maturity (YTM) Formula - SoFi The YTM is stated as an annual rate and can differ from the stated coupon rate. The calculations in the yield to maturity formula include the following factors: • Coupon rate: Also known as a bond's interest rate, the coupon rate is the regular payment issuers pay bondholders for the right to borrow their money. The higher the coupon rate ... Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the coupon rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and coupon rate is 2.375%.

Coupon Rate Calculator | Bond Coupon 12/01/2022 · As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond.It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.. On the other hand, the yield to maturity (YTM) represents the internal rate of return of your bond …

Coupon rate and ytm

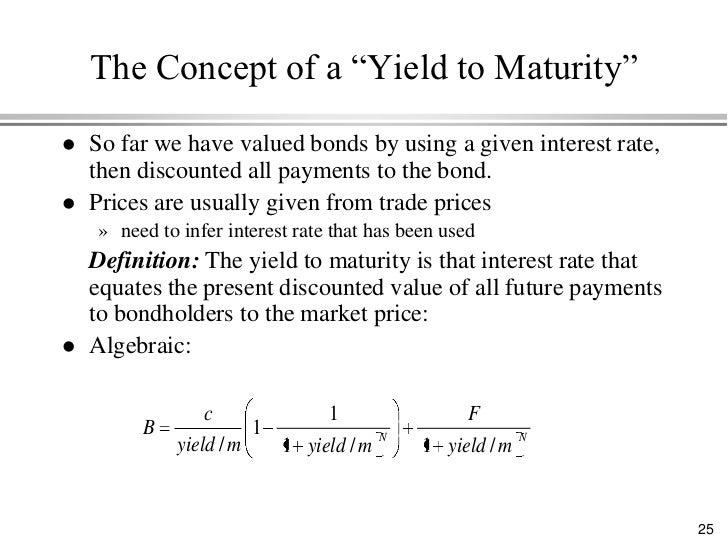

Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ... Yield to Maturity vs Coupon Rate Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond. Coupon vs Yield - WallStreetMojo The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond.

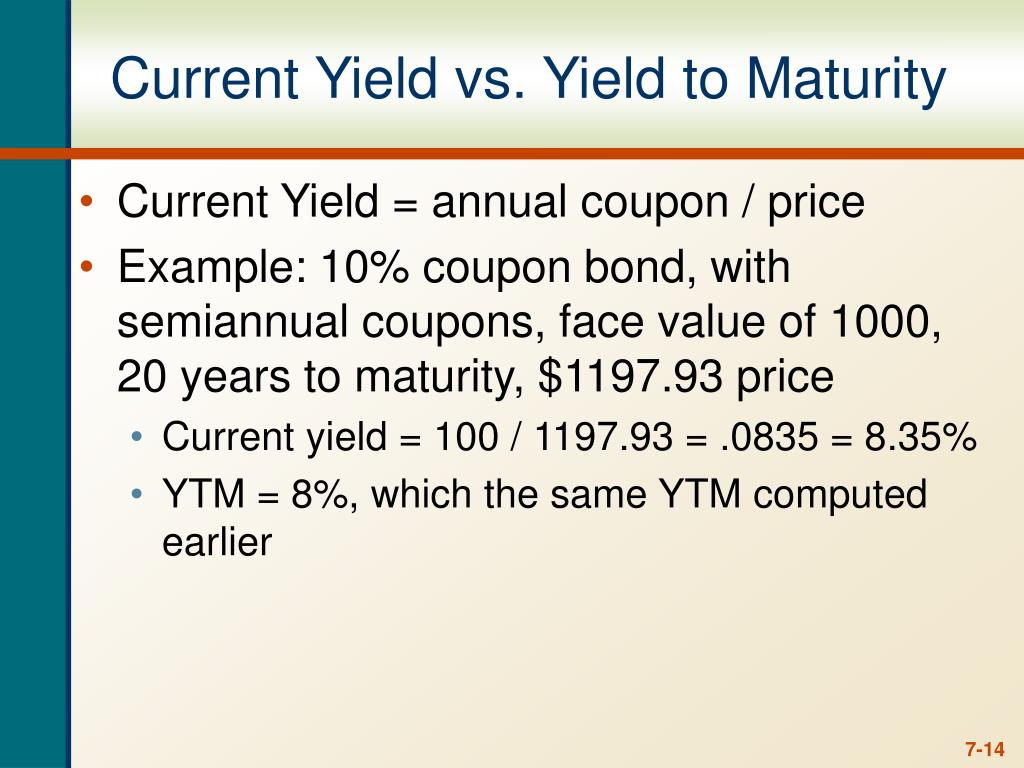

Coupon rate and ytm. Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules: Current Yield vs. Yield to Maturity - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until its maturation date. Bond Basics When a bond is issued, the issuing entity determines its duration, face... Important Differences Between Coupon and ... - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Coupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate ...

Yield to Maturity (YTM) - Scripbox Since the bond is selling at a discount, the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/(1+YTM)^1 + 40/(1+YTM)^2 + 40/(1+YTM)^3+ 1000/(1+YTM)^3. We can try out the interest rate of 5% and 6%. What Is the Difference Between IRR and the Yield to Maturity ... Mar 27, 2019 · Yield to maturity The biggest difference between IRR and yield to maturity is that the latter is talking ... The bond's face value is $1,000 and its coupon rate is 6%, so we get a $60 annual ... Difference Between Coupon Rate and Yield to Maturity (With ... The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Yield to Maturity (YTM) Definition - investopedia.com Sep 06, 2021 · Yield to maturity (YTM) is the total return expected on a bond if the bond is held until maturity. ... The main difference between the YTM of a bond and its coupon rate is that the coupon rate is ...

Concept 82: Relationships among a Bond's Price ... - Donuts The yield-to-maturity is the implied market discount rate given the price of the bond. Relationship with bond's price. A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Coupon Bond Formula - WallStreetMojo Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Coupon vs Yield - EDUCBA We also refer to coupons like the "coupon rate", "coupon percent rate" and "nominal yield". Yield to Maturity is the total return an investor will earn by purchasing a bond and holding it until its maturity date. Yield to maturity is a long-term bond yield and expresses in terms of an annual rate. How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Use the formula = (((/ (+))) /) + / ((+)), where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. If you plug the 11.25 percent YTM into the formula to solve for P, the price, you get a price of $927.15.

Meaning, Formula and Examples - Groww The coupon rate is more or less fixed. How do YTMs work? The price at which the bond can be bought from the market will tell you the present value of all the cash flows in the future. But, bonds are marketable securities, and the prices fluctuate with moving interest rates in the economy. Now, here's the catch.

Bond Yield to Maturity (YTM) Calculator - DQYDJ You can compare YTM between various debt issues to see which ones would perform best. Note the caveat that YTM though – these calculations assume no missed or delayed payments and reinvesting at the same rate upon coupon payments. For other calculators in our financial basics series, please see: Zero Coupon Bond Calculator

Yield to Maturity - Study Finance Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity - including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond's yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

Coupon Rate Definition - investopedia.com 05/09/2021 · For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for ...

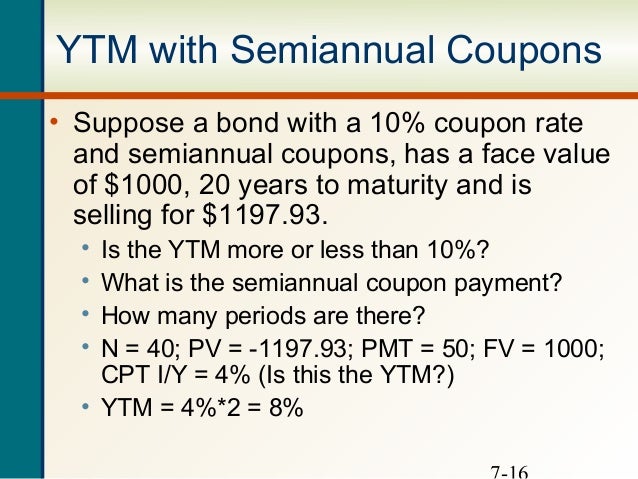

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + =

How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond).

Difference Between YTM and Coupon rates | Difference Between 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

What is the Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation.

Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000. What is the Yield to Maturity?

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Yield to Maturity vs. Coupon Rate: What's the Difference? Aug 22, 2021 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Yield to Maturity (YTM): Formula and Excel Calculator An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value.

Par rate, coupon rate and YTM The par rate is: the COUPON RATE that makes that a bond will sell at par GIVEN interest rates (that is, given by the markt), or the YTM that makes that a bond will sell at par GIVEN coupon rate (that is, the coupon that decides the goverment). I know that it sound stupid and I'm 99,999% sure that the option correct is 1). I need confirmation.

Yield to Maturity Calculator | Calculate YTM 05/10/2021 · Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the ...

![[탑텐몰] 3주년 당신에게 몰입합니다!](https://imgp.topten10mall.com/ost/news/ttm/210217/pc/img/step-2-coupon-10-percent.png)

Post a Comment for "43 coupon rate and ytm"